Welcome to Wealthy Enough - my weekly newsletter where I share actionable insights to build your life of Enough.

Are you Worried about the Stock Market Downturn - November 2025?

✅ Things TO DO during this turbulent times

❌ Things NOT TO DO during these Dips

📝 Action Plan that works

Your portfolio might have just dropped a significant amount over the last few weeks. You are panicking 😰and just want to cut your losses. But before you click that RED SELL button, you need to know these three things—because that decision could cost you so much more over the next decade.

Watching your hard-earned money disappear feels terrible. That churning feeling in your stomach is completely normal. I've been there, millions of other investors have been there too.

But it’s NOT all that bad! Ask me why?

Market downturns are normal and that isn’t the problem. The emotional decisions you make during market downturn is the problem! And most investors make the same three critical mistakes that turn temporary paper losses into real, permanent ones.

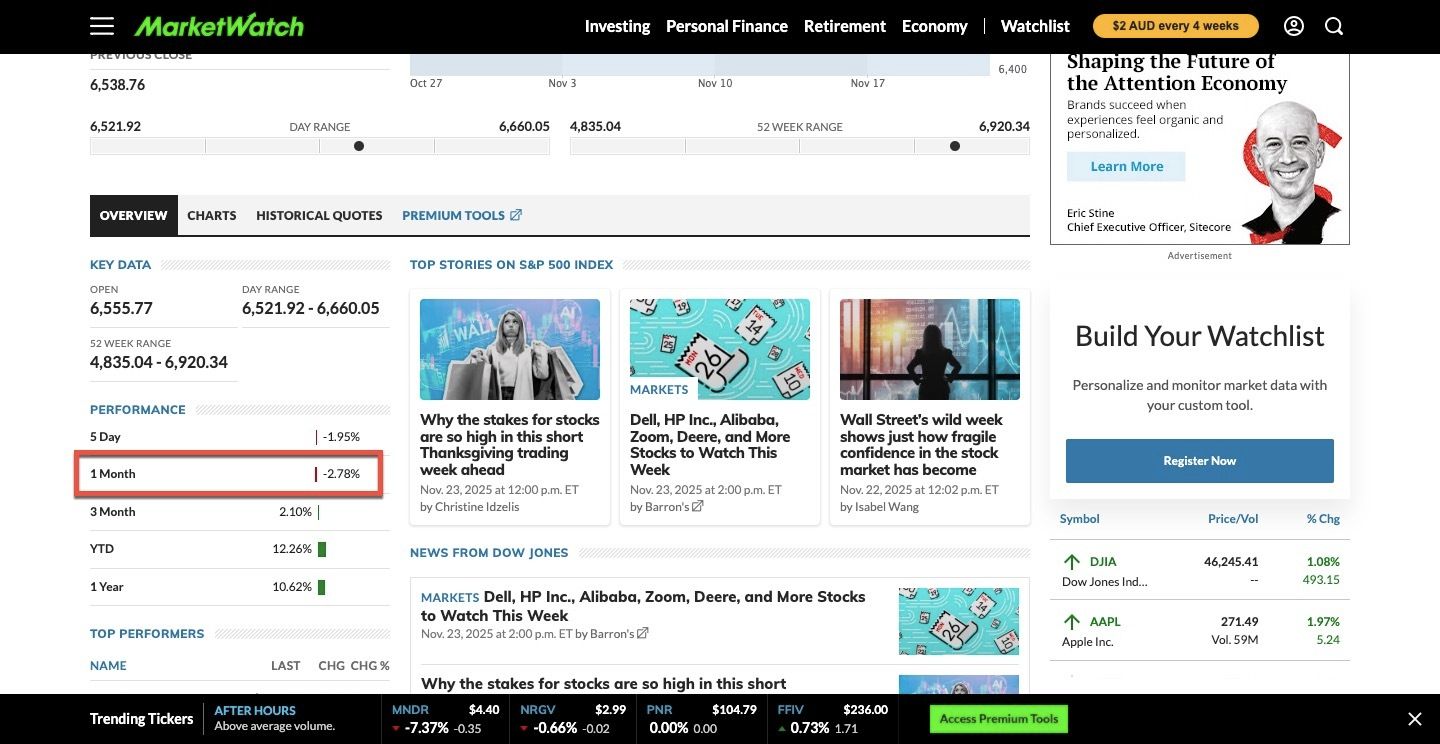

If you are following the news you know the US Market is having a bit of correction. This November the S&P500 dropped almost 3% .

S&P500 Dropped ~ 3% in November 2025 (so far)

And ASX200 almost dropped 6% in November 2025 so far ..

ASX200 dropped ~ 6% in November 2025 (so far)

FUN FACT: since 1950, the S&P 500 has experienced 24 corrections, and 13 crashes. meaning in the last 75 years there were 24 times that the S&P500 had declines of 10% or more and 13 times decline of 20% or more.

All the S&P500 Crashes since 1950

So What’s my point here?

During those dips, investors like you and me felt the same feelings that you’re feeling right now. And every time the market recovered. You see my point?

This math here should scare you BUT for a good reason:

If you sell at a 20% loss, you need a 25% gain just to break even. Sell at 30% down? You need a 43% gain.

How does it work? Here’s how ..

20% down (1/0.8=1.25): need +25%

30% down (1/0.7=1.43): need +43%

40% down … you get the idea the hole gets deeper … 🤯

The S&P 500 has never failed to reach a new all-time high eventually after every crash. Never. Your job isn't to avoid the crash—it's to still be in the game when recovery happens. Riding the wave is what we do 🏄

So here's exactly what to do right now:

Action One: Log out. Stop checking your portfolio every hour. Obsessing over daily numbers makes emotional decisions more likely.

Action Two: Review your asset allocation. If stocks dropping 20% terrifies you, you have too much in stocks for your risk tolerance. But fix this AFTER recovery, not during the crash.

Action Three: Keep investing if you're on a longer timeline. Don't pause your automatic investments. REMEMBER: You're buying on a sale. (think it like a BLACK FRIDAY SALE 😃 )

Action Four: If you have extra cash and a long timeline, consider adding more. Not all at once—spread it out over weeks or months.

Action Five: Only sell if your situation has fundamentally changed—(example: you lost your job, have a medical emergency. But Not because the market is down. [although this is highly discouraged, as I expect you to have an emergency fund for at least 6 months of basic living expenses]

The market crash isn't your problem. Your reaction to it is

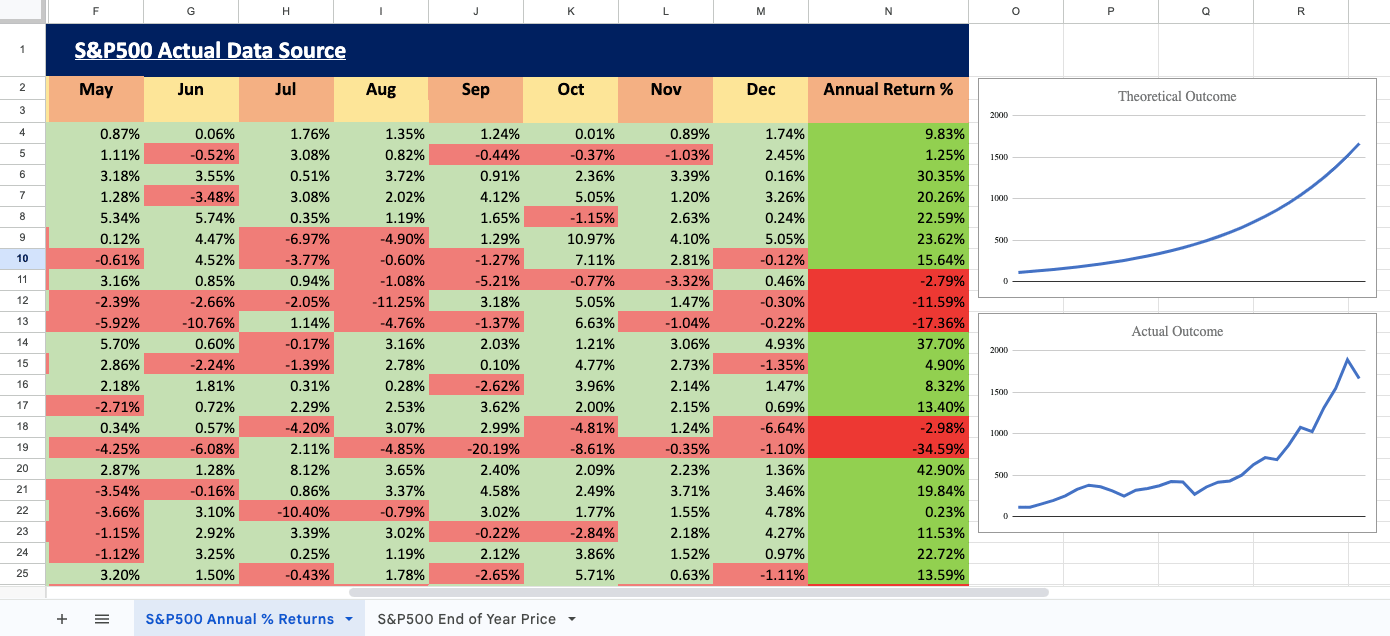

I have studied the LAST 30 years of the S&P500 Index (Month by Month) and created a full video on it (including the Lessons from the Book: The Compound Effect by Darren Hardy)

This will give you a whole new perspective👇

Snap shot of the Real S&P500 Data

🎥 My Most Recent YouTube Video

Books I highly recommend

What I’m working on right now? 👨🏽💻

Summarising all 20 points from this Book - For you to understand the deeper meaning of Money!

That’s all for today I hope you’ve found this helpful and insightful.

Until next week 🙂

Saeem Khan

Creator of Wealthy Enough.

Software Engineer, Investor, Content Creator

www.saeemkhan.com

✅ Connect With Me

Saeem Khan - YouTube Channel : where I share Videos on Personal Finance, Investing, Step-By-Step How-to Guides, Lessons from popular Books, Building Habits and anything that excites me (and you)

Saeem Khan - Instagram : Get to know me more (personally) here ☕️ ✈️

Saeem Khan - Facebook Page : Reels and more shorter contents here!

Saeem Khan - TikTok : If you prefer this, I’m here too 🙂

Saeem Khan - Twitter / X : For more Text-Based conversation 💬

Saeem Khan - LinkedIn : Professional Me 👔 🤓

Email Me 📩 : Have a Topic suggestion or want to get in touch?

Email me at: [email protected]

My Newsletter : Found this newsletter valuable? Share this Link 🔗 with a friend

My Website : For Blogs and More Insights

⛔️ Disclaimer

This content is for educational and entertainment purposes only and should not be taken as financial advice. It doesn’t consider your individual objectives, financial situation, or needs. Please do your own research or consult a licensed financial advisor before making any investment decisions. I only recommend tools I personally use and trust. Some links above may be affiliate links, meaning I may earn a small commission (at no extra cost to you). It’s a simple way to support a small content creator like me. Your support means a lot. Thank you!