Welcome to Wealthy Enough - my weekly newsletter where I share actionable insights to build your life of Enough.

6 Money Habits for 2026, sounds good?

📝 I’ve listed down the ones that I believe will boost your finances in 2026

🔎 You can FOCUS on one or few, but this is a good list of things

📌 Stick to something that really works for YOU

As we are finishing up 2025, I thought it will be a great idea to share these 6 ideas for BUILDING Wealth in 2026.

Blown Away Right? 😀

Let me share something that changed how I think about money forever.

Most financial success isn't about brilliant moves — it's about not screwing up ⛔️

Skip the impulse buys. Avoid high-interest debt. Don't panic-sell during market dips. Keep your commitments. You're not competing against Warren Buffett. You're competing against your own worst impulses!

/

What gets measured gets managed — apply this ruthlessly to your finances ✅

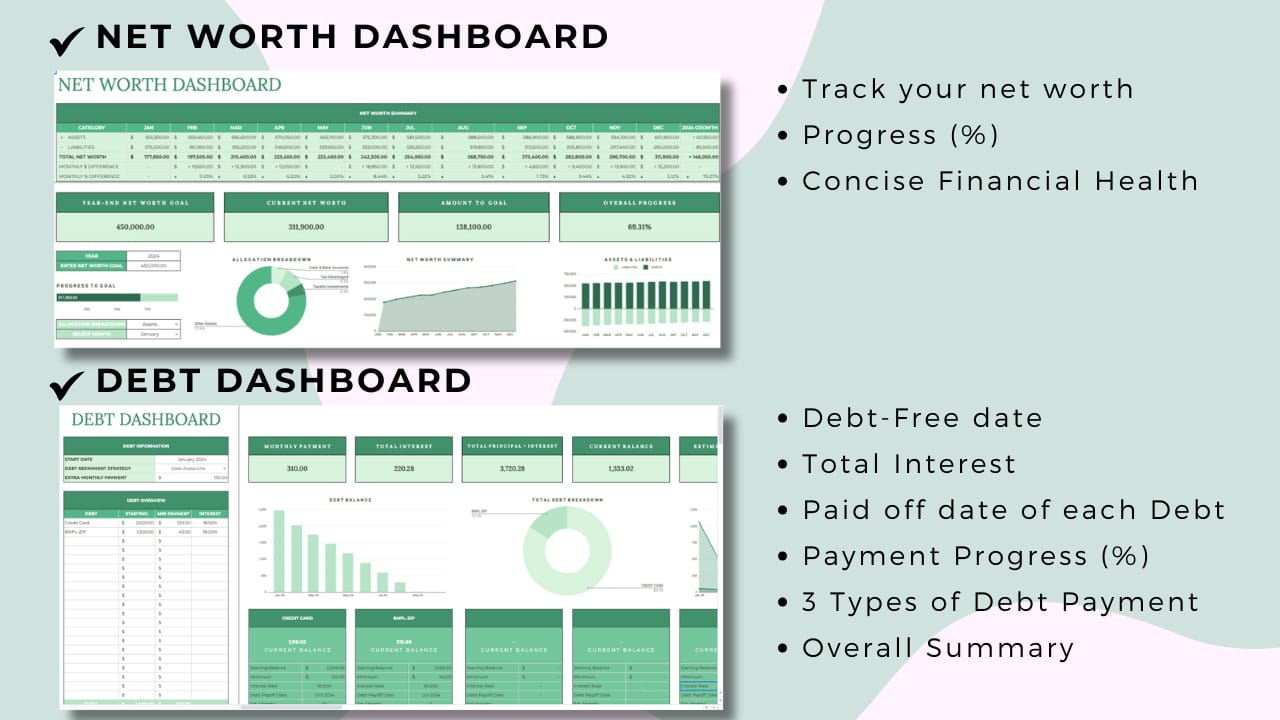

If you're not tracking your financial situation with real clarity, you're flying blind. Find a system — app, google sheet, whatever works — that gives you an honest, comprehensive view of where you stand. The tools are out there. The key is committing to regular check-ins that show you the truth, even when it's uncomfortable!

You can utilise my ALL-IN-ONE PERSONAL FINANCE SOLUTION GOOGLE SHEET if you are looking for an easy solution 👇:

How to Use the Tool Watch THIS:

Maximise your savings rate 💯

The spread between what you earn and what you spend is the engine of financial independence. Small percentage increases have massive long-term impacts thanks to compounding. Learn more about compounding here

Live modestly today to live freely tomorrow!

/

Tweet by Morgan Housel - Author, Psychology of Money

Investments cost time, not just capital ⏳

Every investment has two inputs: money and attention. Some need money and zero time (index funds). Others need money and significant ongoing attention (managing rental properties, running a business, picking stocks).

Always factor in both when evaluating opportunities. A slightly lower financial return with no time cost might be the better deal than a higher return that consumes your weekends.

/

Schedule regular money conversations with your partner 📅

Financial problems are rarely about math. They're about misalignment. Regular financial conversations with your partner — monthly is ideal — create transparency and shared vision.

Focus less on the numbers and more on values. What matters to us right now? What doesn't? Financial alignment creates relationship stability.

Yep! Don’t skip those ☺

Simplify relentlessly.

Complex financial lives are fragile. Scattered accounts, confusing investments, obligations you can't track — this is how people lose control. Simplicity creates resilience.

Automate what you can. Consolidate where possible. Eliminate unnecessary moving parts. The simpler your system, the more likely you'll stick with it.

Get a head start on your Personal Finance, watch these 👇

🎥 This Video MIGHT interest you

📚Books I highly recommend 👍

🤓 2025 YouTube Progress (so far)

Consistency is the key!

That’s all for 2025. I hope you’ve found this helpful and insightful.

If you found this newsletter valuable? Share this Link 🔗 with a friend

Have a safe and a great holiday season 🎁 🎉

I’ll see you next year 🙂

Saeem Khan

Creator of Wealthy Enough.

Software Engineer, Investor, Content Creator

www.saeemkhan.com

✅ Connect With Me

Saeem Khan - YouTube Channel : where I share Videos on Personal Finance, Investing, Step-By-Step How-to Guides, Lessons from popular Books, Building Habits and anything that excites me (and you)

Saeem Khan - Instagram : Get to know me more (personally) here ☕️ ✈️

Saeem Khan - Facebook Page : Reels and more shorter contents here!

Saeem Khan - TikTok : If you prefer this, I’m here too 🙂

Saeem Khan - Twitter / X : For more Text-Based conversation 💬

Saeem Khan - LinkedIn : Professional Me 👔 🤓

Email Me 📩 : Have a Topic suggestion or want to get in touch?

Email me at: [email protected]

My Newsletter : Found this newsletter valuable? Share this Link 🔗 with a friend

My Website : For Blogs and More Insights

⚠️ Disclaimer

This content is for educational and entertainment purposes only and should not be taken as financial advice. It doesn’t consider your individual objectives, financial situation, or needs. Please do your own research or consult a licensed financial advisor before making any investment decisions. I only recommend tools I personally use and trust. Some links above may be affiliate links, meaning I may earn a small commission (at no extra cost to you). It’s a simple way to support a small content creator like me. Your support means a lot. Thank you!