Welcome to Wealthy Enough - my weekly newsletter where I share actionable insights to build your life of Enough.

Do you feel like you’re drowning in debt?

✅ You are NOT Alone

🛠 You can FIX this

📝 Your Step-By-Step Action Plan

Every time you think about your High Interest debts 💳 you probably clench your jaw 😬 like this:

It’s perfectly normal to feel like that. But No matter how bad it is, there is always a way out, NOT immediately BUT Eventually!

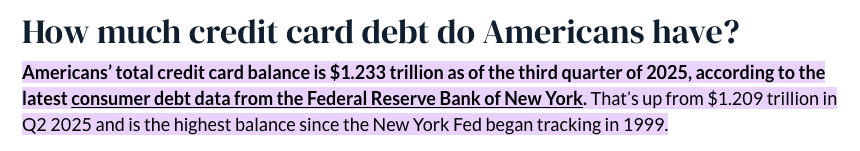

Here are some jaw-dropping stats 😧 :

Americans Credit Card Debt Numbers

Australian Debt Numbers

So, to get yourself out of debt, here’s my top 2 strategies

Strategy 1: Snowball Method ❄️

This is my favourite strategy, because this ACTUALLY works. But how does it really work?

Well, this is where you focus on paying your smallest balance first.

Here are the Exact steps how it works:

Step 1. List your Loans from SMALLEST to LARGEST regardless of Interest rate.

Step 2. Make minimum payments on all your loans EXCEPT the SMALLEST one.

Step 3. Put as much EXTRA money as you can on your SMALLEST Loan until it’s completely paid off.

Step 4. REPEAT Until every Loan is Paid off in full.

But why does it work so well?

Well, because you’re targeting the smallest loan first you win early, and this boosts your motivation to keep going.

But there are some down-sides too! Since, you are targeting the SMALLER loans first, bigger loans will be ignored until the smaller ones are paid-off.

Think it like a small snowball that rolls down the hill. As it rolls down, it picks up speed, and more snow, until it turns into a giant snowball by the time it comes at the bottom.

Strategy 2: Avalanche Method 🏔

Although you tend to save more amount in Interest, because you start targeting the loans with HIGHEST INTEREST. However, Negative Psychological effect is MORE, unlike Snowball Method there is NO quick wins and therefore it is hard to stay motivated. That’s WHY isn’t NOT my number 1 pick.

Here’s how it works:

Step 1. List your Loans from HIGHEST Interest rate to LOWEST Interest rate.

Step 2. Make minimum payments on all your loans EXCEPT the one with the HIGHEST Interest Rate.

Step 3. Put as much EXTRA money as you can on the Loan with the HIGHEST Interest Rate until it’s Paid off in FULL.

Step 4. REPEAT Until every Loan is Paid off in full.

Avalanche, where a large mass of snow breaks loose and rushes down a mountainside.

Here is my Step-By-Step Video on HOW TO PAYOFF Your DEBTS👇

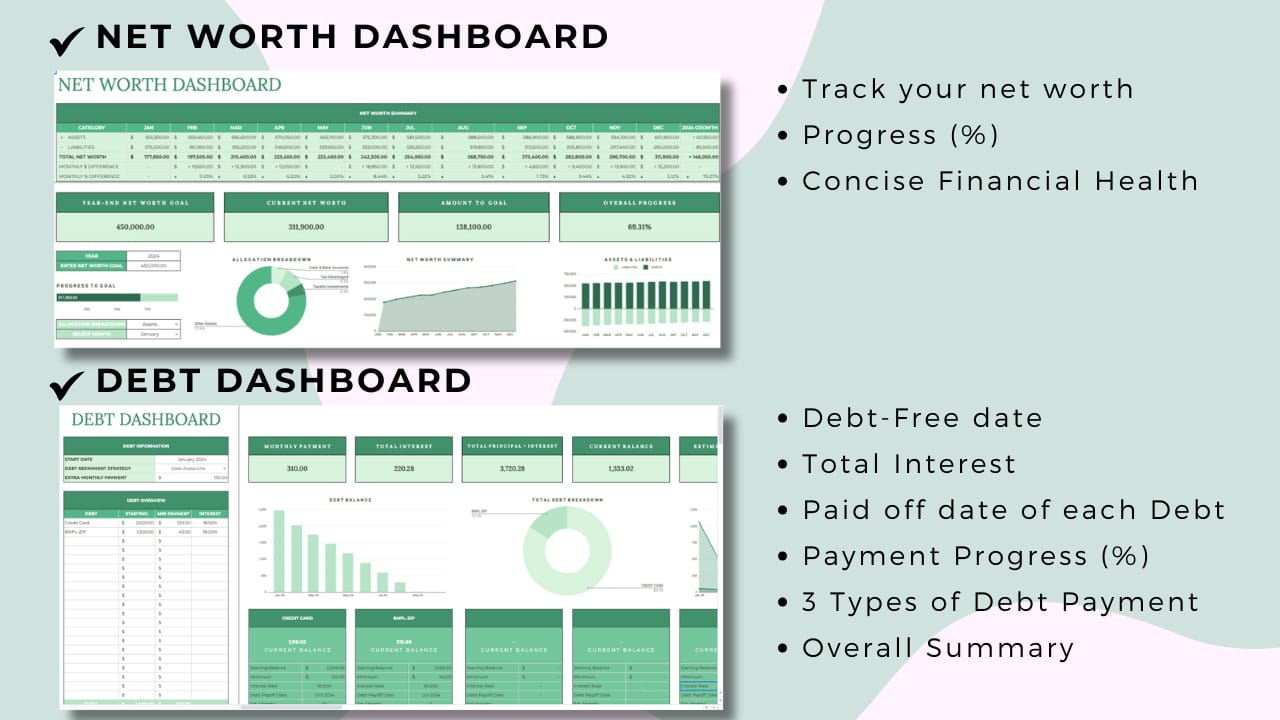

Snap shot of the Debt Dashboard, explaining how it works

💸 Get your DEBT PAYOFF TOOL👇

(AVAILABLE IN 4 COLOURS - and Lots more!)

🎥 This Video MIGHT interest you

📚Books I highly recommend 👍

👓 What I’m reading right now?📗

I’m just intrigued by the content of this book. Hoping to share the lessons with you all soon

That’s all for today. I hope you’ve found this helpful and insightful.

If you found this newsletter valuable? Share this Link 🔗 with a friend

Until next week 🙂

Saeem Khan

Creator of Wealthy Enough.

Software Engineer, Investor, Content Creator

www.saeemkhan.com

✅ Connect With Me

Saeem Khan - YouTube Channel : where I share Videos on Personal Finance, Investing, Step-By-Step How-to Guides, Lessons from popular Books, Building Habits and anything that excites me (and you)

Saeem Khan - Instagram : Get to know me more (personally) here ☕️ ✈️

Saeem Khan - Facebook Page : Reels and more shorter contents here!

Saeem Khan - TikTok : If you prefer this, I’m here too 🙂

Saeem Khan - Twitter / X : For more Text-Based conversation 💬

Saeem Khan - LinkedIn : Professional Me 👔 🤓

Email Me 📩 : Have a Topic suggestion or want to get in touch?

Email me at: [email protected]

My Newsletter : Found this newsletter valuable? Share this Link 🔗 with a friend

My Website : For Blogs and More Insights

⚠️ Disclaimer

This content is for educational and entertainment purposes only and should not be taken as financial advice. It doesn’t consider your individual objectives, financial situation, or needs. Please do your own research or consult a licensed financial advisor before making any investment decisions. I only recommend tools I personally use and trust. Some links above may be affiliate links, meaning I may earn a small commission (at no extra cost to you). It’s a simple way to support a small content creator like me. Your support means a lot. Thank you!